Amazon.com: Nike Air Max Plus II Hombres Running Entrenadores Cq7754 Zapatillas Zapatos, Valor Blue Ghost Green 400, 7 : Ropa, Zapatos y Joyería

Hombres hombres y mujeres nueva casual de manga corta de moda Luigis Mansion 3D cómoda ropa de niños tendencia de alta calidad camiseta CUI rocic.com

Compra Tv Inteligente al por mayor. Devoluciones gratuitas y condiciones de pago a 60 días en Faire.com España

Amazon.com: Nike Air Max Plus II Hombres Running Entrenadores Cq7754 Zapatillas Zapatos, Valor Blue Ghost Green 400, 7 : Ropa, Zapatos y Joyería

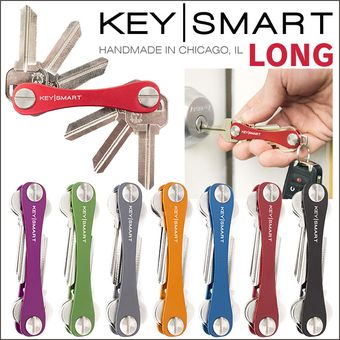

Moda Organizador clave flintronicLlavero de Cuero GenuinoBolsillo inteligentes Llavero Ropa, calzado y complementos TC4169978

Teléfono metálico Gamepad disparador Botón de fuego Aim Key Smart Phone juegos móviles L1R1 Shooter | Linio Chile - GE018EL0JNES9LACL