For Sale!! Nike Air Zoom Total 90 2 US 10.5 and Adidas Predator Pulse "Fingerprint" US 11 | BigSoccer Forum

Lucho on Twitter: "No hubo ni habrá unos botines como los Nike total 90, fueron un antes y un después. Me acuerdo que los usaba para jugar al fútbol, ir a la

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/KOZ2VMTLSBGODILYONMJT4M4ZI.jpg)

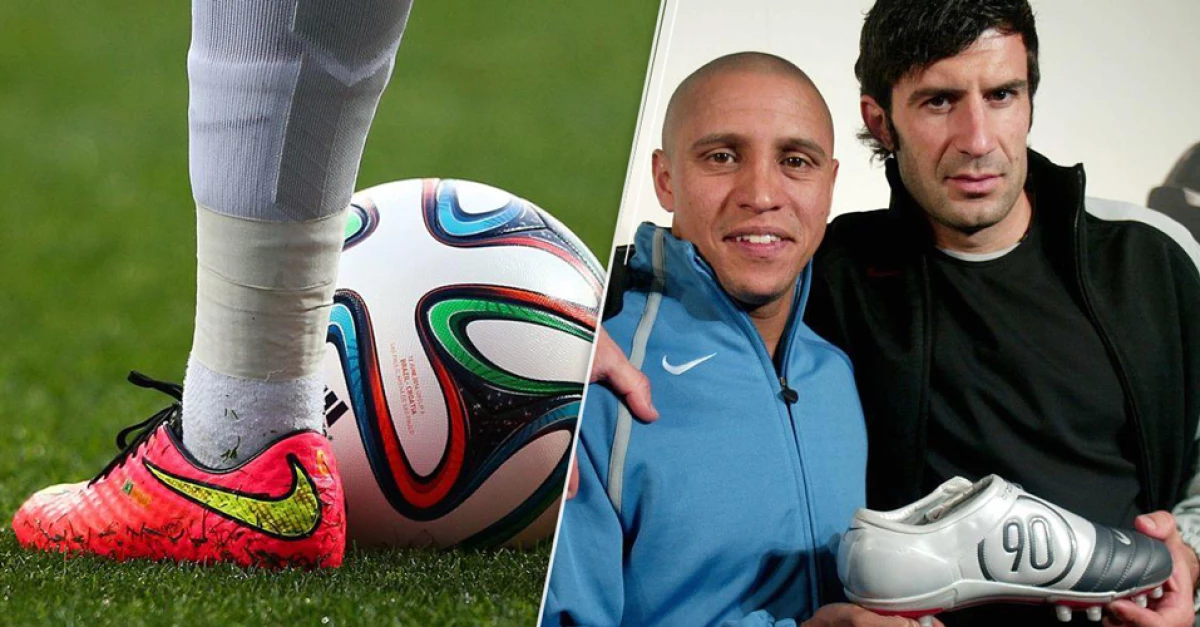

Chimpunes clásicos de fútbol: Nike, adidas, Pumas y todas las botas que en la infancia soñamos con tener | FOTOS | FUTBOL-INTERNACIONAL | DEPOR

International Champions Cup - You can only pick 3 boots to wear for your footballing career 🧐⚽️ Which are you going with ⁉️ | Facebook

Predators, Total 90s, Puma Kings... Ranking the 13 classic football boots of the noughties Messi, Ronaldiniho and Beckham wore