Rainbow Loom Fruit Off the Loom - Grapes Charm | Rainbow loom, Rainbow loom charms, Rainbow loom designs

New Baseball or Tennis Ball Bracelet - Advanced - Rainbow Loom, Crazy Loom, Wonder Loom, Bandaloom - YouTube

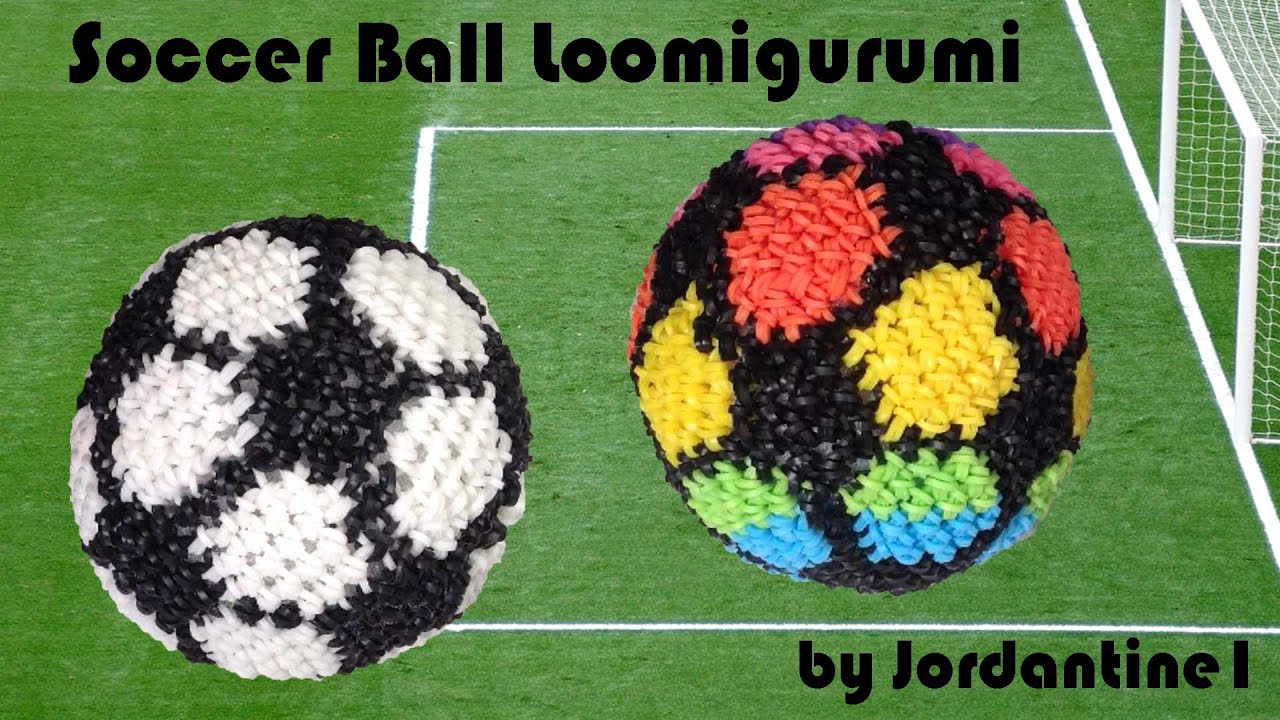

Fishtail Rainbow Loom Bracelet with Soccer / Ball, Women's Fashion, Watches & Accessories, Other Accessories on Carousell