Nike Jordan Bajas Rojas Negras por 59, Oferta, Among the first leaks is this rad Air Jordan 1 High Light Army with a brushed look | 95€ | Envío Gratis

Las zapatillas Nike Air Jordan más elegantes que has visto en tu vida, las adidas de running más ecológicas y otros lanzamientos de la semana | GQ España

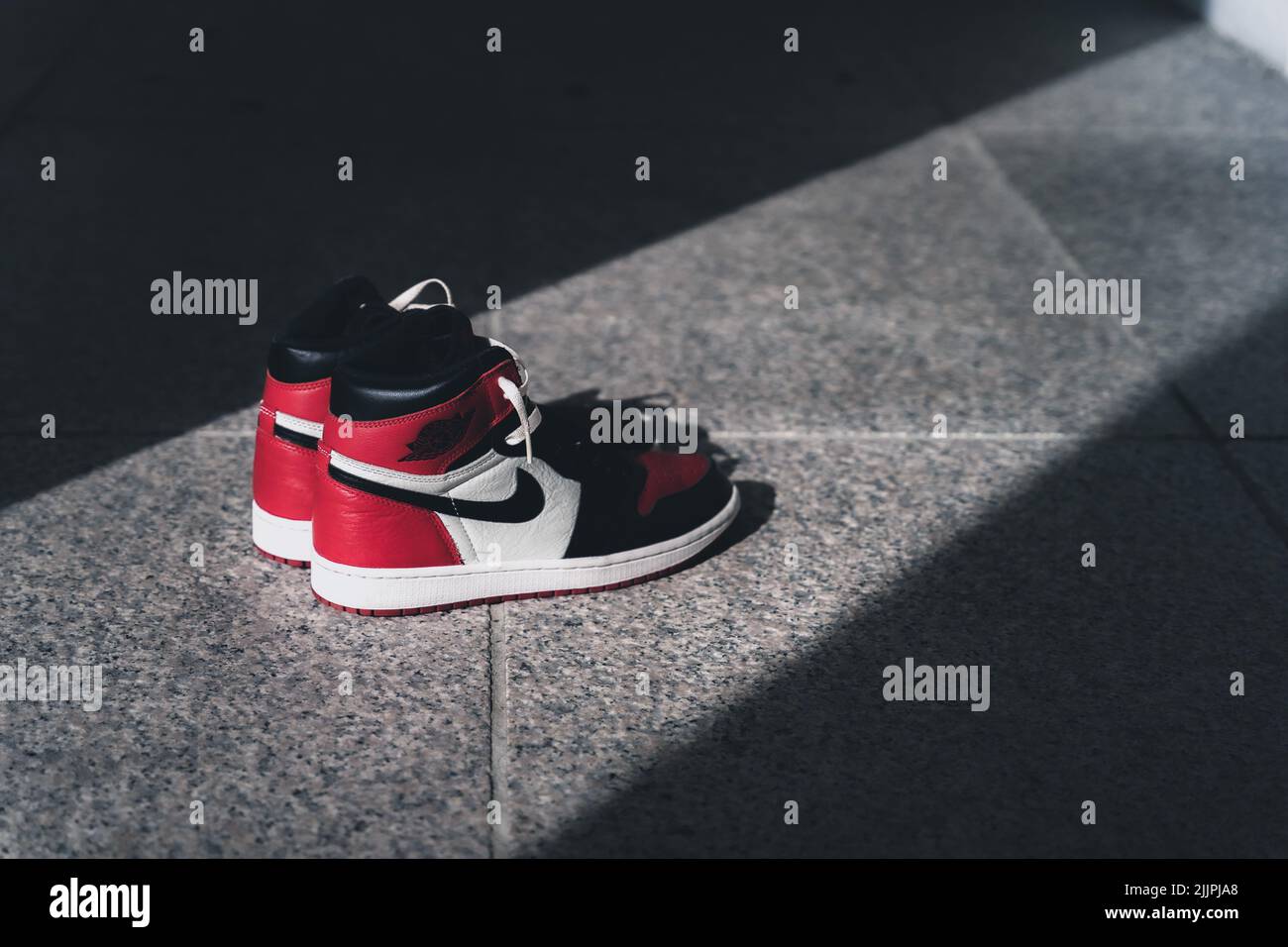

New! Nike Air Jordan 1 Black and Red Now available for € 69.95 at PostuZap ... | Jordans, Jordan 11 outfit women, Outfits with jordan 1s fashion styles