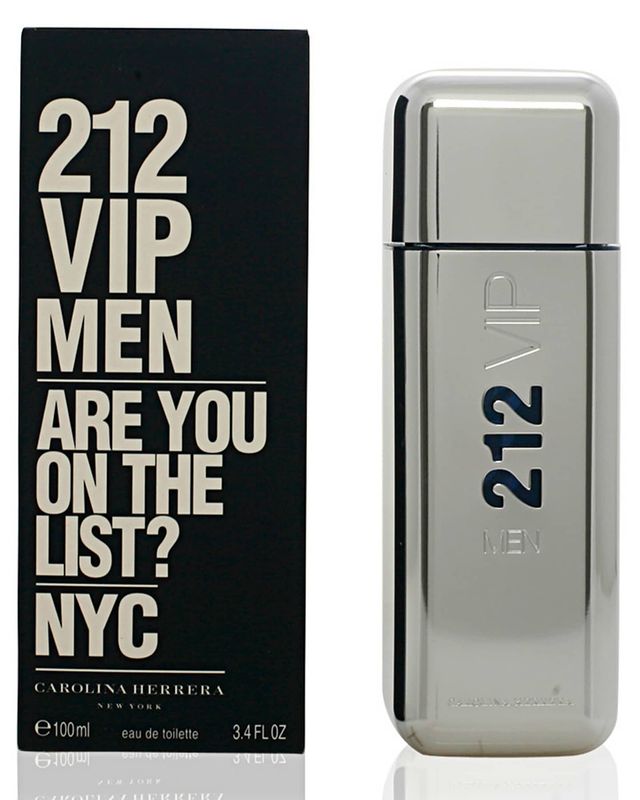

Amazon.com: Perfume para hombres 212 VIP de Carolina Herrera : CAROLINA HERRERA: Belleza y Cuidado Personal

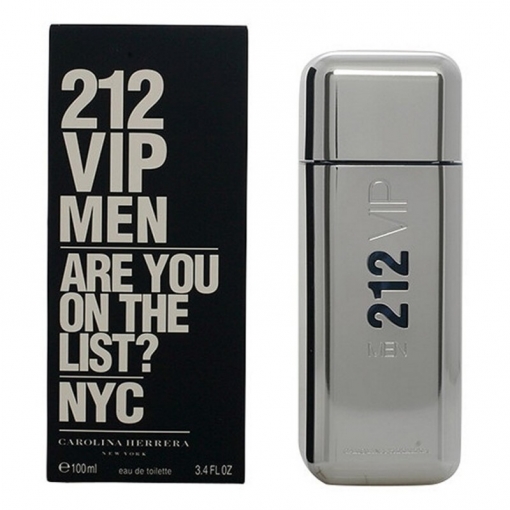

Amazon.com: Carolina Herrera 212 Vip Hombres Nyc Edt para Hombres 6.8 Oz/ 200 Ml, 6.8 Fl Oz : Belleza y Cuidado Personal

212 Vip Hombre Juego de Regalo de 2 piezas de Metal por Carolina Herrera 3.4 EDT + Gel de Ducha 8411061868720 | eBay

Perfume Hombre 212 Vip Carolina Herrera Edt Capacidad 100 Ml con Ofertas en Carrefour | Las mejores ofertas de Carrefour

Amazon.com: Perfume para hombres 212 VIP de Carolina Herrera : CAROLINA HERRERA: Belleza y Cuidado Personal