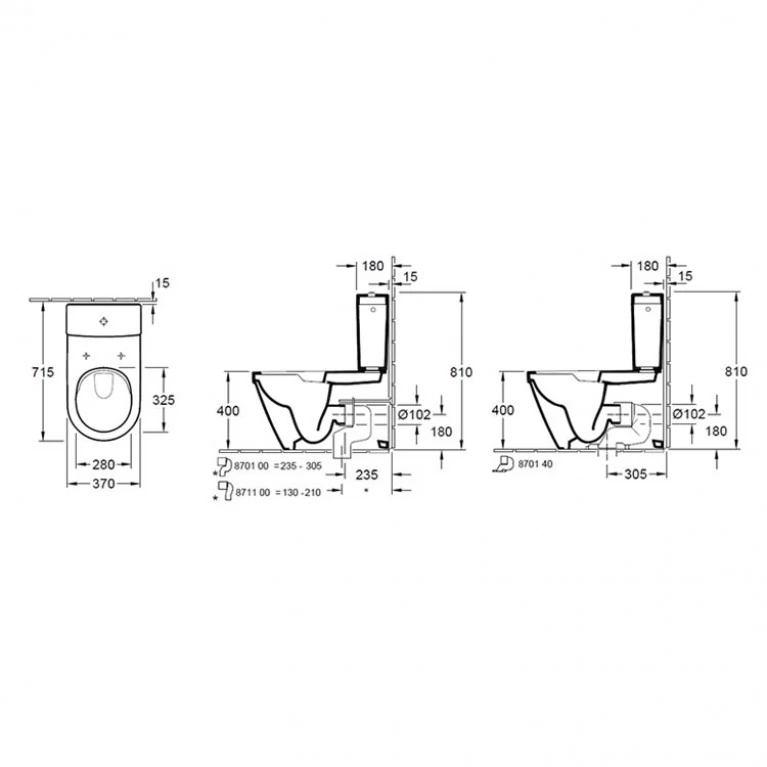

Унитаз напольный Villeroy & Boch Architectura 5691R001 с бачком и сиденьям Soft Close арт. 5691R001+5787G101+98M9C101 - купить по выгодной цене, отзывы, характеристики | Интернет-магазин сантехники СантехШара: Киев, Одесса и другие города Украины

ᐈ Унитаз Villeroy&Boch Architectura Rimless 370x700, белый (5691R001) • Купить в Киеве, Украине • лучшая цена в магазине SanSmart

Avento Washdown WC for Close-coupled WC-suite, Horizontal Outlet 5644R0 | Villeroy & Boch AG | NBS Source

Купити Унітаз Villeroy&Boch Architectura 5691R001 + 5787G101 + 98M9C101, ціна 17599 грн - Prom.ua (ID# 1283760062)