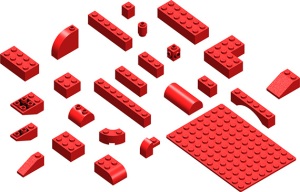

Oferta del día en el set Lego Classic de 790 piezas: hasta medianoche cuesta 35,95 euros con envío gratis

Amazon.com: LEGO – Figurita de colección Serie 1 mini figura sueltas Super Luchador : Juguetes y Juegos

Amazon.com: Piezas sueltas surtidas Bionicle Hero Factory, 1 libra, de la marca LEGO : Juguetes y Juegos