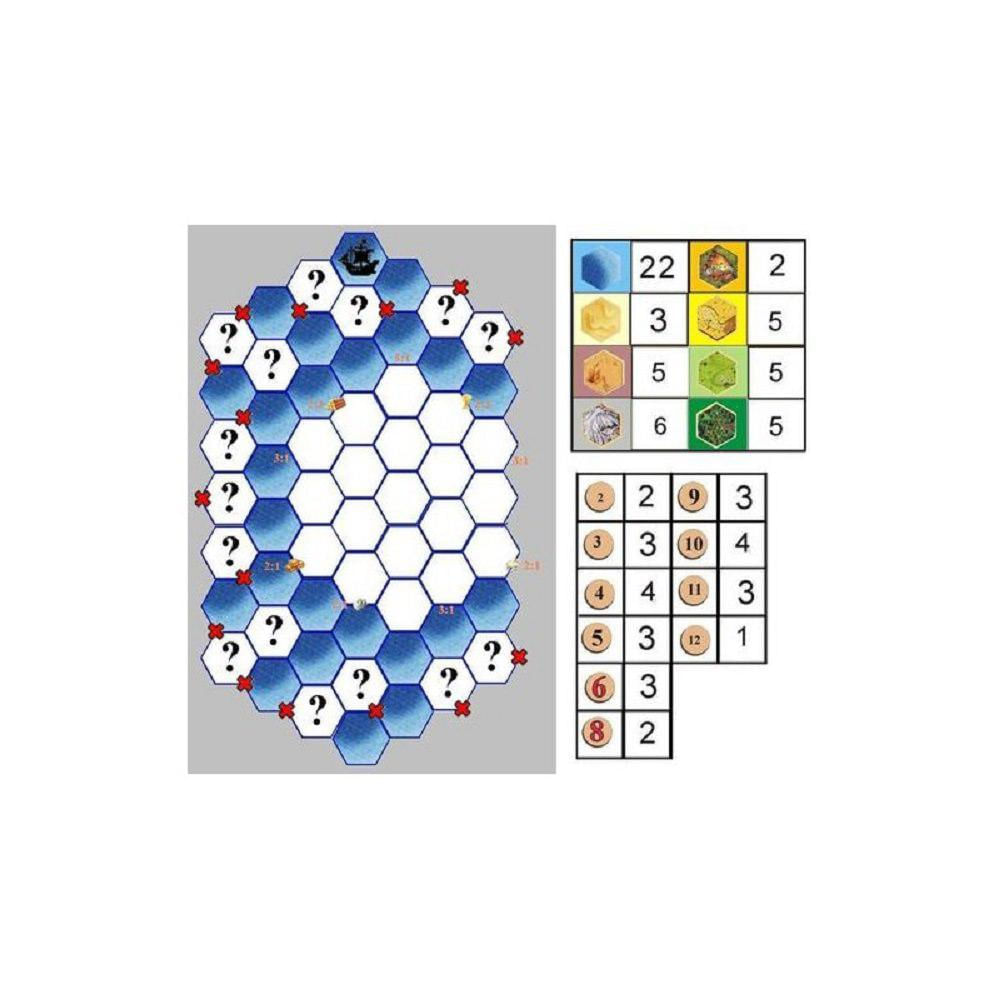

CATAN Treasures, Dragons and Adventurers Scenario Expansion | Strategy Board Game | Family Game for Adults and Kids | Ages 12+ | 3-4 Players | Average Playtime 60-180 Minutes | Made by CATAN Studio : Toys & Games - Amazon.com

CATAN Treasures, Dragons and Adventurers Scenario Expansion | Strategy Board Game | Family Game for Adults and Kids | Ages 12+ | 3-4 Players | Average Playtime 60-180 Minutes | Made by CATAN Studio : Toys & Games - Amazon.com

🐑🌲🌾EXPERTOS DE CATAN🌾🧱🏔 | Buen día!. Pongo a la venta estos 3 Catan: Tesoros, Dragones y Aventureros edición KOSMOS; nuevos, sellados

Amazon.com: CATAN Treasures, Dragons and Adventurers Scenario Expansion | Strategy Board Game | Family Game for Adults and Kids | Ages 12+ | 3-4 Players | Average Playtime 60-180 Minutes | Made by CATAN Studio : Toys & Games