Find the best price on L'Oreal Elvive Total Repair 5 Instant Miracle Hair Treatment 200ml | Compare deals on PriceSpy NZ

Amazon.com: L'Oréal Paris Elvive Extraordinary Oil Tratamiento capilar nutritivo profundo, 3.4 onzas : Belleza y Cuidado Personal

Encontrados! – más 7 productos de farmacia para método curly girl (no poo, low poo y co-wash) – GAROTA CON RULOS – Por Giu Araujo

RADIO LA VOZ DE MILAGRO - Las mejores promociones las encuentras en Comercial Roxana 🤩💥 Recibe el 20% de descuentos en productos ELVIVE hasta el 31 mayo. 📌Matriz Milagro Calderón y Rocafuerte (

Amazon.com: L'Oréal Paris Elvive Extraordinary Oil Tratamiento capilar nutritivo profundo, 3.4 onzas : Belleza y Cuidado Personal

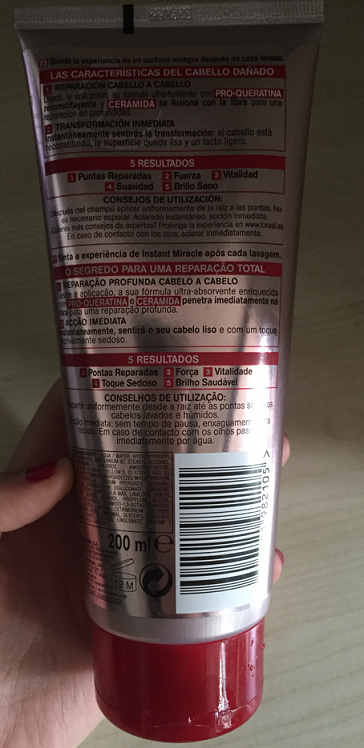

L'Oréal Paris Tratamiento Capilar Fluido Con Tecnología Lamelar, Con aclarado, Para Pelo Largo y Dañado, Cabello Hidratado, Suave y Brillante, Elvive Dream Long Magic Water, 200ml : Amazon.es: Belleza