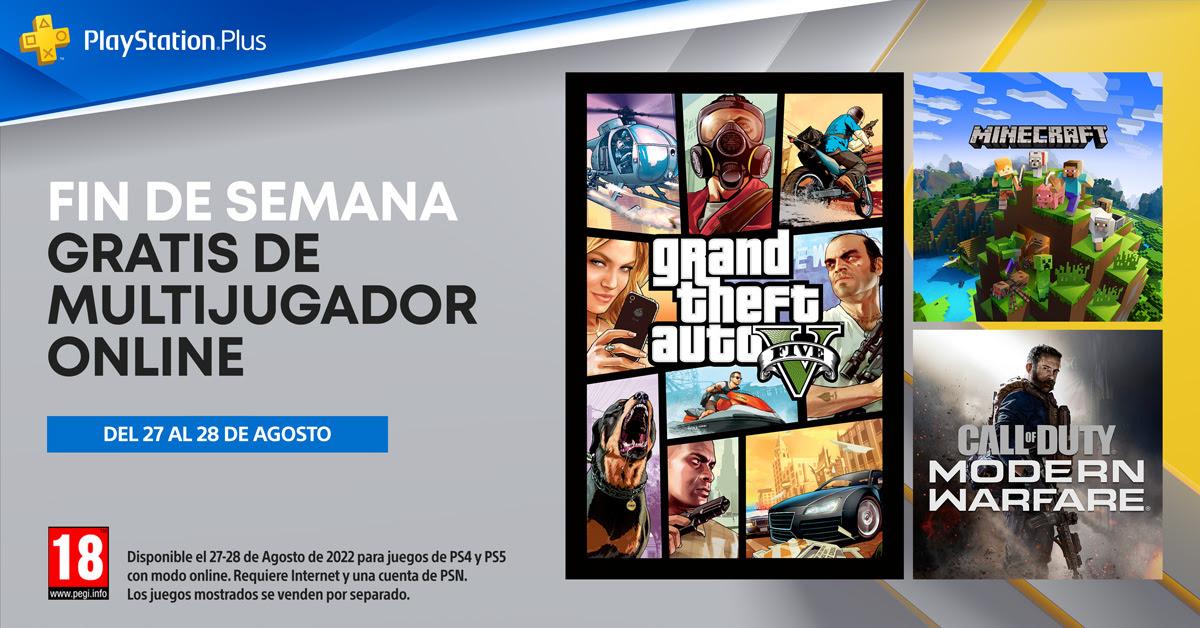

Anunciado un fin de semana multijugador gratuito en PS5 y PS4: juega online a tus juegos favoritos el 27 y 28 de agosto | Hobbyconsolas

No tenés PlayStation Plus? Estos son todos los juegos gratuitos que podés jugar sin pagar la suscripción - Cultura Geek

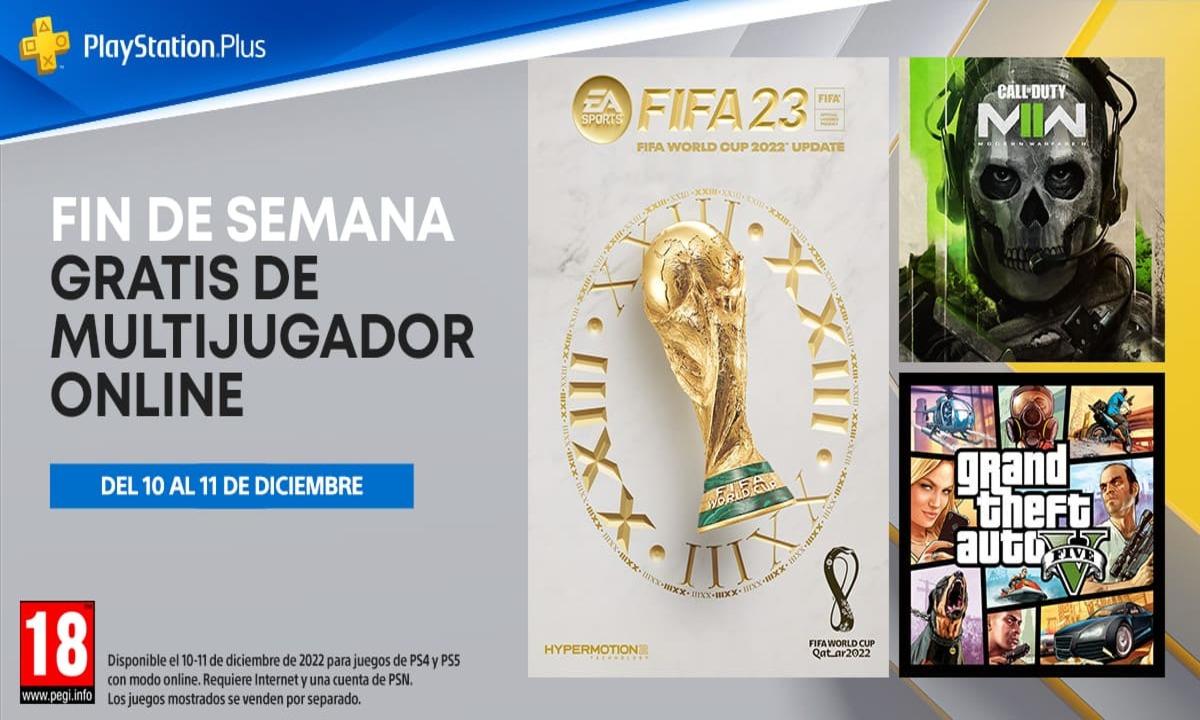

Este fin de semana puedes jugar gratis al multijugador online de cualquier juego de PS4 y PS5 sin estar suscrito a PlayStation Plus