nike zoomx vaporfly next vs hoka Long-Distance one one carbon - zapatillas de running HOKA Long-Distance ONE ONE asfalto neutro amortiguación media apoyo talón All Gender zapatillas de running HOKA Long-Distance ONE

Amazon.com: Reebok Floatride Run 2.0 - Zapatillas de correr para hombre, color cian/negro/verde solar 9.5 : Ropa, Zapatos y Joyería

adidas Streetball Active Purple Shock Cyan FV4525 Release Date - SBD - las mejores zapatillas deportivas adidas sneakers

Abstract Cyan Blue Kryptonite High-Top Sneakers | Sneakers, High top sneakers, Sneakers & athletic shoes

Amazon.com: adidas Harden Vol. 4 - Tenis de baloncesto para hombre, Cian/Rosa real/Blanco Ftwr, 7.5 : Ropa, Zapatos y Joyería

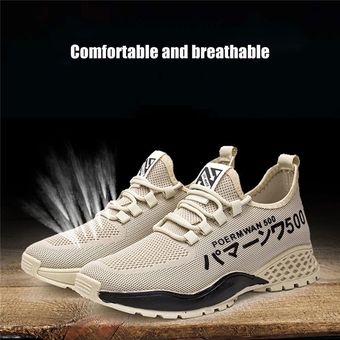

cyan#Zapatos de seguridad para el trabajo para hombre para verano zapatillas protectoras con amortiguación de aire transpirables con punta de acero Moda rocic.com