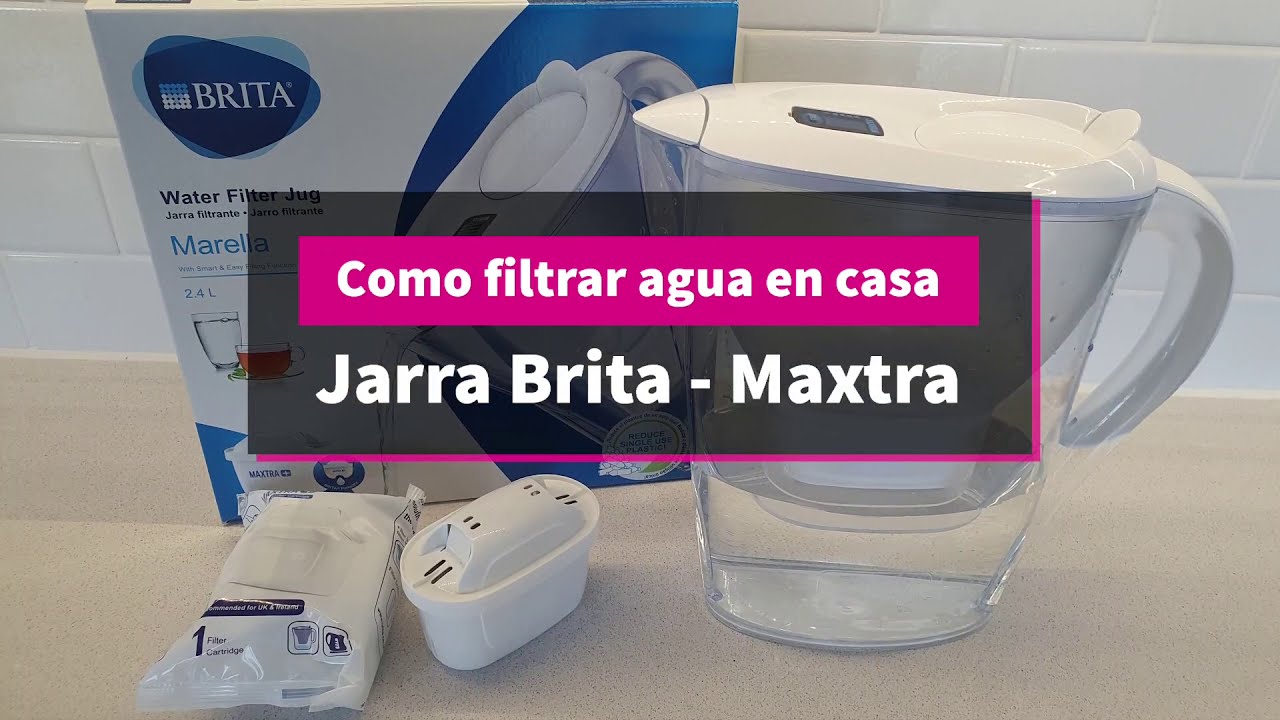

El uso jarra Brita Maxtra carbono filtros Brita Filtro Brita Mavea Bosch Tassimo Laica - China Jarra de agua alcalina precio

⇒ Jarra brita style azul+1 filtro maxtra ▷ Precio. ▷ Comprar con los Mejores Precios. Ofertas online

BRITA MAXTRA + Replacement Water Filter Cartridges , Compatible with all BRITA Jugs - Reduce Chlorine , Limescale and Impurities for Great Taste - Pack of 3